A personal note…

By Don Southerton

Reflecting on Earth Day, my ties to Green and Sustainability have reached back in time and continue today.

They parallel my work with Korea and globally. In the mid-2000s, I was an advisor to developing Incheon, South Korea Songdo IBD (now Songdo International City), today one of the 3 Incheon Free Economic Zones (IFEZ). Incheon Free Economic Zone

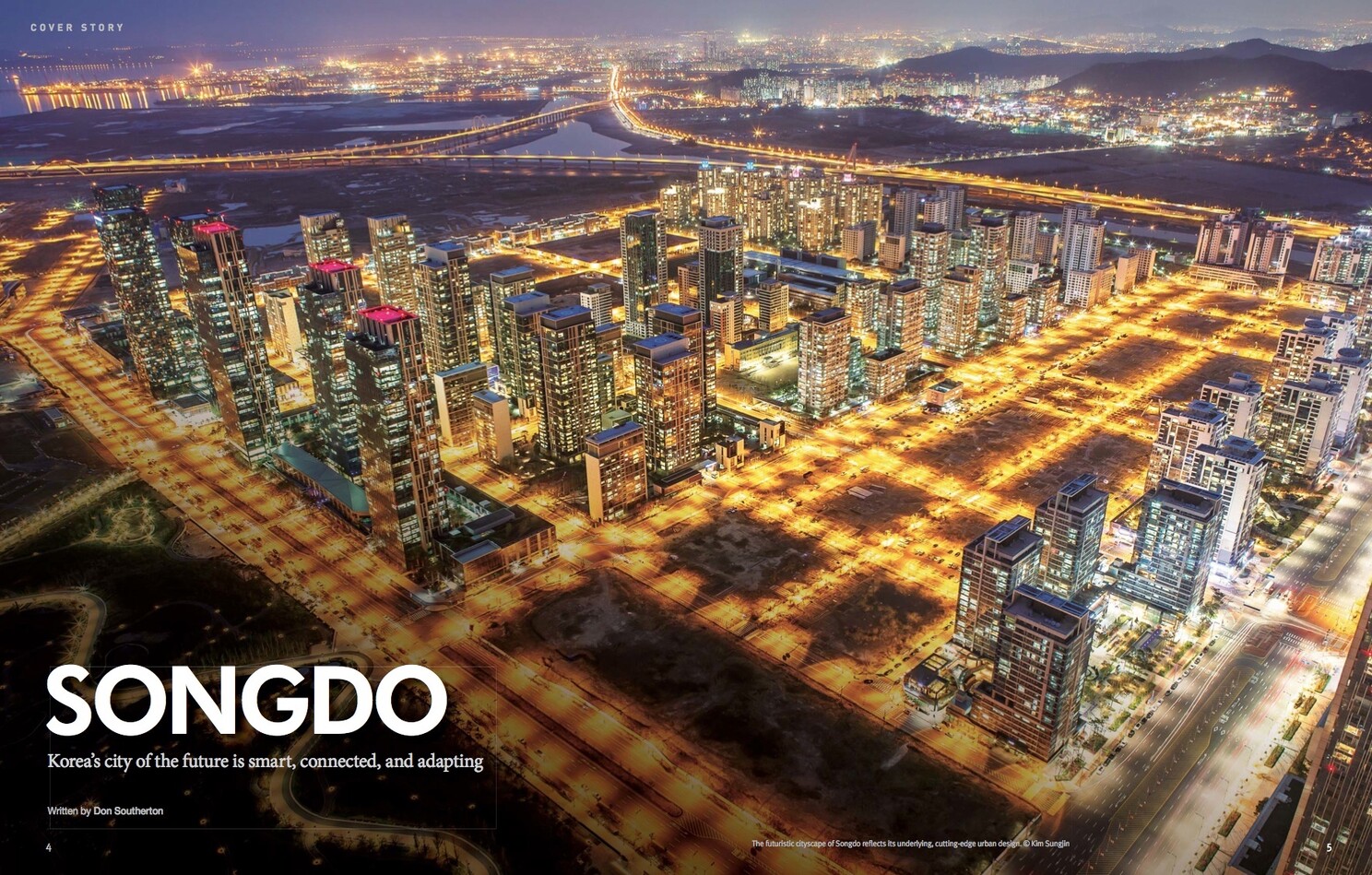

Developed as a global model for urban sustainability, Songdo was envisioned as a Green, high-technology city of the future, and at the time, it was one of the world and Korea’s most significant foreign real estate development projects.

Built on reclaimed land and with partners like Kohn Pederson Fox, Cisco, and United Technology, the forward-leaning project also showcased the first LEED-certified buildings in South Korea and Asia.

In conjunction with the Songdo project and aligned with my work for Hyundai Motor Group, we had the opportunity for a VIP visit to Hyundai Motor’s R&D. I even got to fuel their 1st Gen Hydrogen Fuel Cell Electric Vehicles (FCEV), and then test drive the next generation of EV vehicles. At this time, Songdo’s leadership was very interested in FCEV buses for the district and powered by hydrogen.

Songdo’s innovations were again the subject of my 2013 article for the Korean government’s Ministry of Culture, Sports & Tourism, highlighting the city’s Green accomplishments.

I also hosted a 2013 BBC World Service visit, too. We showcased Songdo’s Green smart city capabilities, capped off by an interview with Cisco’s former Chief Global Strategist Wim Elfrink. Wim was the thought leader who popularized the term IoT — the Internet of Things.

A day later, we visited Hyundai Motor’s Eco Lab and test-drove their 3rd Gen FCEV, a first-of-its-kind production SUV, which was soon launched in Korea and then California.

In the years that followed, as companies I supported moved to mobility and EVs, I, too, shifted my research and work to these new sectors. Electrification has been and continues to be a major part of my work, leading to an ongoing immersion in the sector supporting Korean startup Grinergy and Green lithium battery technology.

In the last months, my interest has expanded to the Critical Mineral sector as well as recycling of black mass and rare earth sustainability and supply chain.

I’d add, most recently, my work, number of articles, and support have returned to the City of Incheon, IFEZ, and Songdo, as well as Cheongna International City, and the airport’s Yeongjong International City. Each, with a renewed Green and sustainability agenda.

https://www.brandinginasia.com/category/analysis/columns/korea-facing

Finally, as we reflect on Earth Day, in both my work and pursuits, I find the need to embrace Green technologies and renew efforts, fueled by government and private funding and with a growing public interest in sustainability.

Earth Day- Earth Week- Earth Month 2024

Questions? Comments? Have a project in mind or need support?

Urgent requests Text at 310-866-3777